What is a token in cryptocurrency?

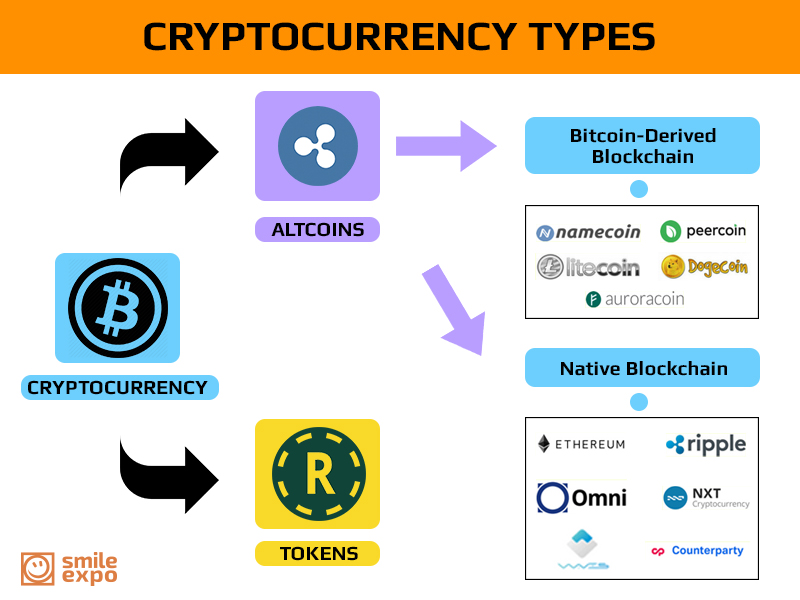

Cryptocurrencies and crypto tokens both come from the blockchain world, but they are not the same thing. How are they issued, what are their functions and what is the difference between crypto coins and tokens? We are suggesting finding out.

What is a token and how does it appear?

In simple terms, crypto tokens represent any digital asset that can be traded, or certain units of value, and are placed on the top of blockchain.

Crypto tokens are launched through ICOs. The process of token creation is easy, as it is only necessary to follow the existing offered templates.

What is the difference between tokens and cryptocurrencies?

The most important thing to understand is that cryptocurrencies, or altcoins, are coins which are built on the bitcoin’s open-source protocol or have their own base – blockchain. Tokens, however, are issued on top of another blockchain, for example, the blockchain of ETH.

So, crypto coins exist independently, while tokens can’t exist without some other infrastructure. Unlike crypto coins, they also have no value by themselves, as they just represent value.

Coins and tokens also differ in some other elements:

Structure

Cryptocurrencies are used for making transactions as they serve as means of payment. They represent digital financial assets and play a role of real currencies. Tokens, on the other hand, can perform more types of operations and can be used in more various situations, for example, they can represent companies’ shares.

Creation

Creation of crypto coins is a complicated process, as the protocol should be modified completely every time – this is how coins get unique features. Creating tokens is an easier process, as they don’t require their unique base to be launched.

Sometimes, however, it is possible to hear that some altcoins are called tokens. In this case, the term is true if the altcoin is built on the platform of another coin, as STORJ, ATS or WCX coins exist on Ethereum platform.

Token types

Tokens usually stand for assets or utilities, however, they can be divided into five groups, according to what they represent:

Currency tokens

This is the most known kind of tokens as it includes the majority of them. Currency tokens are most of the times referred to as cryptocurrencies – they represent a storage of value and are utilized for making transactions as money.

Utility tokens

This kind of tokens is used for accessing platforms which provide various services. Tokens launched via ICOs usually belong to utility tokens – after their distribution, holders are able to use the platform in the future.

Asset tokens

According to their name, asset tokens represent physical assets such as gold, silver or other precious metals. This token type is usually backed by assets which regulate tokens’ price.

Equity tokens

When equity tokens are distributed through ICOs, holders become owners of the issuer – organization or project. These tokens are very popular since they bring the shares in a company.

Reputation and Reward Tokens

These tokens are given by companies to active users of their platforms. Usually, those who participate in the platforms’ processes a lot – create content, interact with other users or come up with something significant for the project – gain trust. Issuing reward tokens, the platform acknowledges users’ reputation.

Tokens can also be united in groups regarding different type of their features:

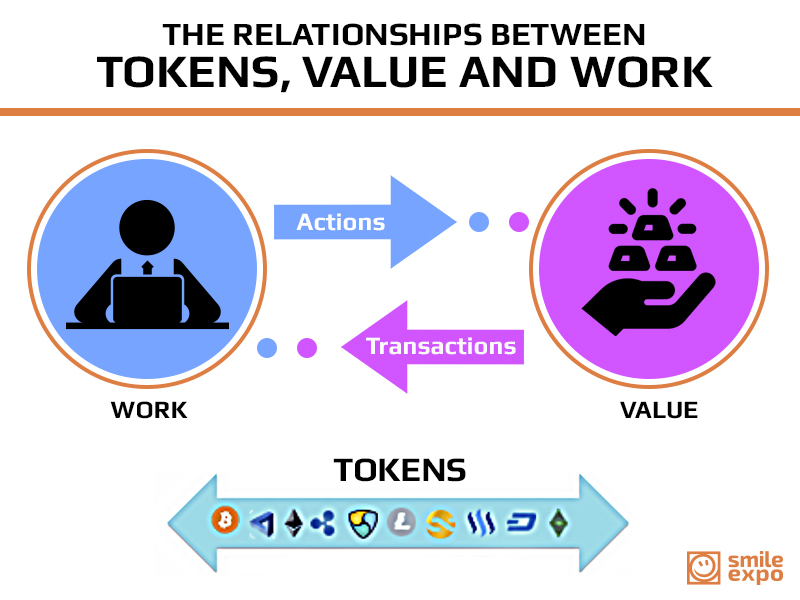

Usage tokens

While these ones are distributed, holders get the right to use the platform.

Work tokens

However, if holders want to not only have an access to the platform, but to also make a certain contribution, they would need work tokens.

Some tokens, such as ETH, fall under both categories, providing access to network and allowing to take part in its work processes.

There is also a third way of grouping tokens:

Intrinsic/native/built-in tokens

These ones are not backed by anything and fulfil functions of DLT base. For instance, BTC and ETH are intrinsic tokens.

Application tokens

This type of tokens exists within the application and give holders rights to work with it. having an application token equals creating content, making updates or deleting information from the app.

Asset-backed tokens

These tokens are always backed by certain assets and are equal to them, just being in a digital form.

Why are tokens a big deal?

It is known that conducting ICOs is a very popular way to raise capital for further development of the platform. Let’s discover why else tokens are so important, what the aims of issuing them are and what factors issuers keep in mind before conducting ICOs.

Raising a capped amount

Token issuers sometimes have a goal of limiting the total raise to be in alignment with real network development cost.

Selling a fixed amount of total token supply

Some platforms and projects are aimed at keeping certain amount of tokens for development team or investors, instead of selling everything.

Distributing tokens widely

Certain issuers do not plan giving a large number of tokens to few holders, instead, they want to distribute their tokens to as many people as possible – they see it as a sign of greater decentralization.

Selling tokens at the market value

In some cases, platforms give buyers the possibility to determine the value of the token. However, it may be problematic in some cases, as it may be difficult to value tokens if the network is not launched yet.

Guaranteeing tokens for all buyers

Some projects hold tokens for some time on purpose – they do not need to get capital quickly as their aim is to attract as many buyers as possible.

Tokenization and ICOs will be discussed at the Blockchain & Bitcoin Conference Switzerland. More details about the event and registration – on the official website.